Many Metro Area Cities Paralyzed By Inability to Raise Revenues

Officials say state continues to divest locally while Headlee Law cripples tax collection

The State of Michigan last week announced that it has a 315-million dollar revenue surplus for the coming fiscal year. Governor Snyder says the money may go towards things like debt payments…school security and improving state roads. What does that mean for other streets in towns and cities?

As Amy Miller reports…. many local government officials say the state government is refusing to pass along tax dollars that could help Michigan municipalities facing financial crises and crumbling infrastructure…

Click on the audio player above to hear the story.

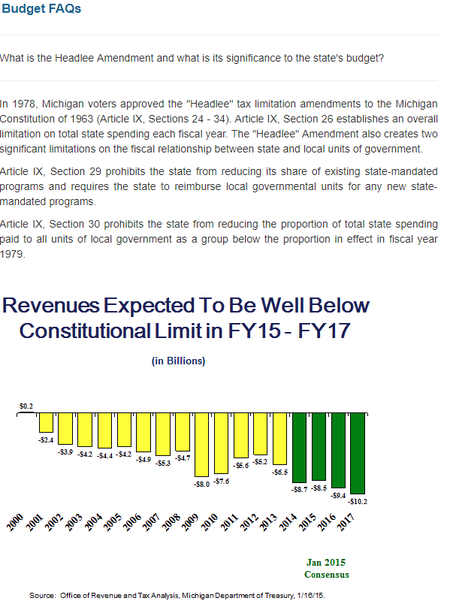

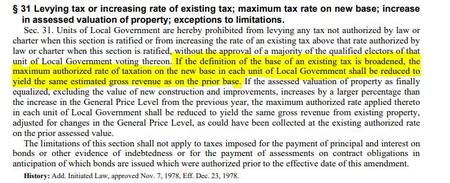

Analysts say the downward spiral in local tax and other revenues started when Michigan voters approved the Headlee Amendment in 1978 and then in 1994 added Proposal A. Both severely limit local governments ability to levy property taxes. Michigan Municipal League Deputy Executive Director, Tony Minghine, says the two measures layered on top of one another crippled local governments financially.

“Most people probably think because the economy is strong that the communities are doing well. And we’re not, because the system isn’t built that way. And they’ve gotta understand and draw those connections between our broken funding system and the lack of services that they see. Whether it’s the baseball field isn’t cut or the roads are maintained to a level that they like. Those are all manifestations of this broken system” -Tony Minghine, MML

Local governments increasingly rely on revenue from property taxes. But during the 2009 recession, property values plummeted. Southeast Michigan Council of Governments Finance and Operations Specialist, Bill Anderson, says that means towns and cities lost millions of dollars in revenue.

“During the great recession when all the property values went down, property taxes that the individual paid went down. Now when the values are going up, that became the new base, and everybody’s paying a lot less in property taxes and that means there’s a lot less to provide the kinds of services that people need” -Bill Anderson, SEMCOG

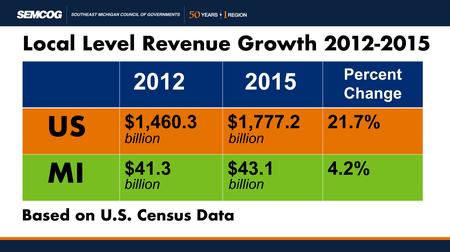

Anderson says the State of Michigan grew it’s revenue by 13% last year. That’s close to the national average. But, Anderson says, local revenues are nowhere near that level.

“Michigan local government’s saw a 4% increase in their revenues over three years but then when you see that local governments in the rest of the nation saw their budgets go up by 20%, how do you expect to compete when you don’t have money to pave your roads and then you understand why there’s no money there to do it from the local perspective” -Bill Anderson, SEMGOC

And expenses for local governments keep going up, especially covering underfunded pensions and retiree health care costs. Recent data show, across Michigan, some 44-percent of municipal retiree benefit programs have no funding mechanism in place at all. And Anderson says the state is very stingy about sharing revenue with cities, towns and villages.

“The fact is that the state has been diverting over 600 million a year away from the counties and cities and villages and townships of this state to prop up their operations and have been doing it for over a decade” -Bill Anderson, SEMCOG

The 600-million dollars Anderson refers to is part of the municipal revenue sharing program, which distributes sales tax collected by the State to local governments. Most communities use at least part of the money to rebuild roads, but the Michigan Municipal League’s Tony Minghine says data show while many Michigan roads are crumbling, no other state has cut investment in local governments more than here.

“I would bet everything I have that if you lined up 100 people and said ‘everyone gets to decide where to direct their tax dollars, I think you’d get an overwhelming local response to that. But what happens is, it’s easy to decide ‘we’ll take those dollars away from local government and put them into state government, some of it being the balance sheet at the state level, some of it being other departments around the state, but it has a real impact on the ability of local governments to provide services” – Tony Minghine, MML

Policymakers in Lansing justify the drop in municipal revenue sharing the same way the Chair of the House Local Government Committee, Representative Jim Lower views it, that the program was never meant to be set in stone.

“There was formulas put in place 20 years ago about what revenue sharing would be going out into the future, but they were non-binding, so we weren’t able to keep up with what the formula said we would do as a state and so consequently the locals are saying that they are underfunded as a result of that. But the money that’s actually gone in there has been increases over the about last five years” -MI Rep James Lower (R-Montcalm)

Lower says it’s wrong to say the State is refusing to share 600-million dollars per year with local governments.

“To characterize it as being withheld, it’s not as if we collected the money and then simply send it to them, we didn’t have the money either. The state had massive budget deficits during the last decade. So it wasn’t as if the money was coming in and we weren’t sending it to ‘em, the money just wasn’t there, so that’s why it didn’t keep up with projections” -Rep. James Lower

Lower says it’s incumbent on communities to find ways to increase their tax base through residential and commercial growth. Local officials say it’s not that simple. The City of Oak Park, for instance, is seeing commercial growth along 8 Mile Road and increases in home values since the Great Recession. But Oak Park City Manager… Erik Tungate, says municipalities still don’t have enough funding to plan for critical infrastructure upgrades like resurfacing roadways.

“During the recession we lost about 40% of our total taxable value. And when, for example, the rate of inflation that’s set by the state of Michigan is set at 1% that we can gain back, then that means it would take us about 40 years to gain back the value that was lost. And that’s over 60% of our sources of revenue” -Erik Tungate, City Manager, Oak Park

Tungate estimates that over the last 15 years, his city has lost 22 million dollars in revenue sharing alone. He says now that the state has seen a couple of years of surplus revenue, it’s time to pay cities back

“There’s no question that roads and bridges and investing in mass transportation in Detroit are the top priorities of the state. So I’d like to see the state truly send those dollars to funding infrastructure projects rather than paying down their own debt or doing whatever else in their own system. They’ve used our money for many, many years now to have these surpluses, it’d be nice to see that investment come directly back to the cities” -Erik Tungate

Tungate says unless local governments receive more revenue sharing or policymakers and voters change the current law, community leaders will increasingly ask residents to approve special assessments or millages to compensate for the lost revenue. And in the meantime, roads in many of those communities will continue to get worse.

Read about the Headlee Amendment here

Read about the Headlee Override here