Tax rebate checks coming to 700K Michigan households early next year

The rebates are a part of the state’s expanded Earned Income Tax Credit passed by the Democrat-led state legislature earlier this year.

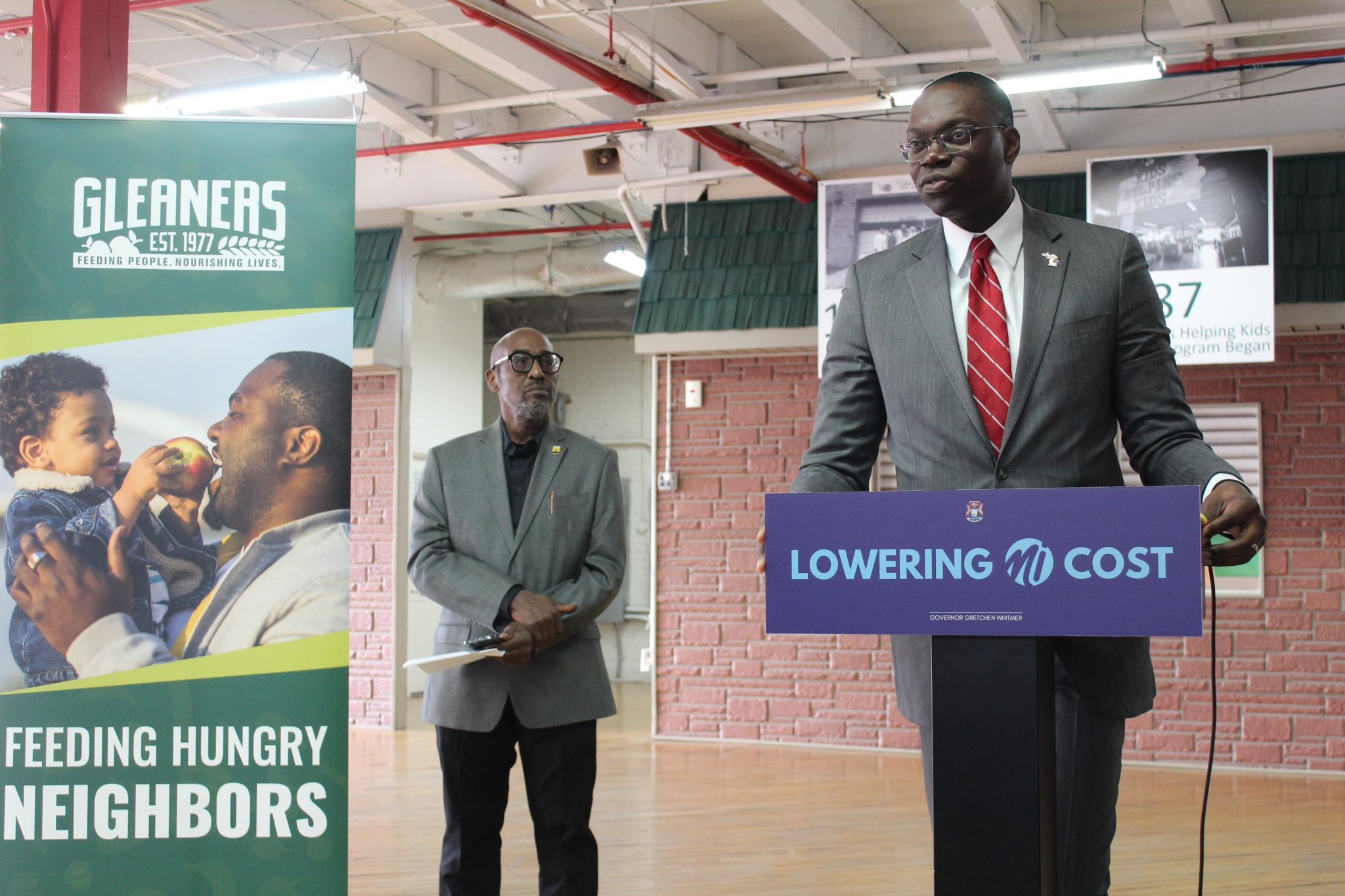

Lt. Gov. Garlin Gilchrist addresses the media and community stakeholders at Gleaners Community Food Bank on Thursday, Dec. 14.

About 700,000 families in Michigan can expect tax rebate checks from the state averaging approximately $550 starting on Feb. 13, Gov. Gretchen Whitmer announced Thursday.

The rebates are a part of a boost to the Earned Income Tax Credit that was passed by the Democrat-led state legislature in March, which expanded the credit from 6% to 30%.

At a press conference at Gleaners Community Food Bank in Detroit on Thursday, Lt. Gov. Garlin Gilchrist said a procedural vote stopped the checks from being sent out sooner.

“We had hoped to have this relief be in people’s pockets earlier this year but Republicans in the legislature blocked that from going into effect immediately.”

While the expanded state match doesn’t take effect until 2024, the legislation applies retroactively to 2022, meaning eligible Michiganders can receive both an additional check from their 2022 tax return and receive the full 30% tax credit on their 2023 tax filing when they file next year.

Gilchrist says the rebates will not only help families, but also boost the state’s economy.

“It’s real money at a time when stuff is so expensive,” he said, adding that the Earned Income Tax Credit boost shows the Democrats’ “aggressive posture on wanting to make sure that we can lower costs in Michigan — that we can put money into people’s pockets so they can do what they need to do.”

Eligible residents do not need to submit any additional paperwork to receive the extra credit for 2022, as the Department of Treasury will automatically process checks for Michiganders who submitted their 2022 tax return and confirm eligibility for the additional state credit.

Specific credit amounts will depend on several eligibility factors, including income, filing status, number of “qualifying children,” and/or if you are disabled.

For more information about Michigan’s Earned Income Tax Credit, visit michigan.gov/taxes/iit/eitc.

Trusted, accurate, up-to-date.

WDET strives to make our journalism accessible to everyone. As a public media institution, we maintain our journalistic integrity through independent support from readers like you. If you value WDET as your source of news, music and conversation, please make a gift today.