Governor Snyder Says “There’s Not The Resources” In State Budget For Roads

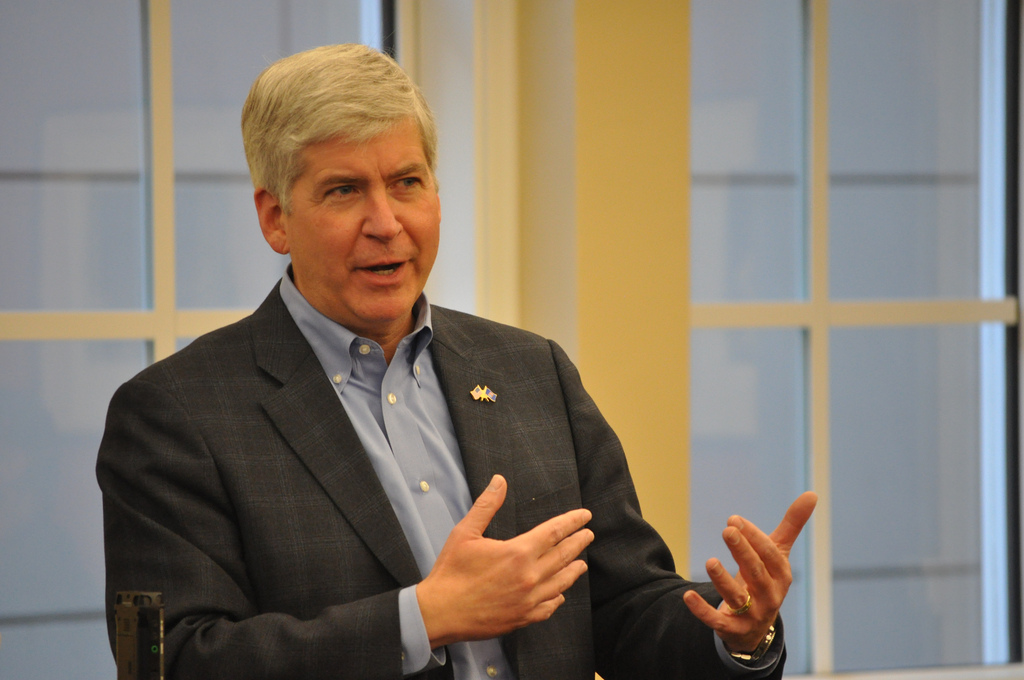

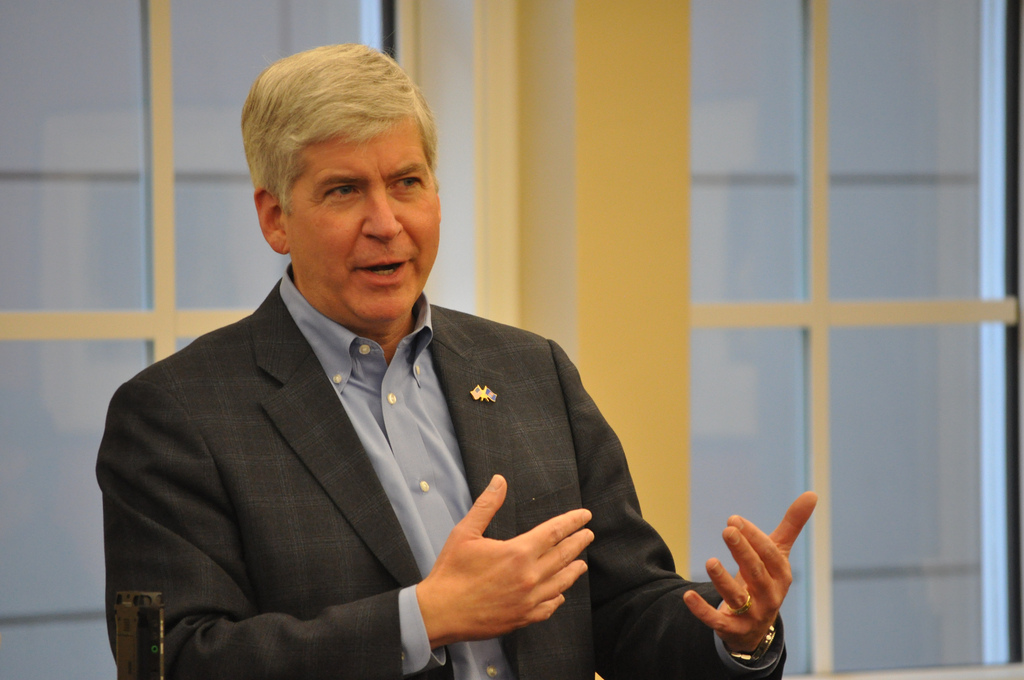

Governor Snyder discusses Prop 1 –the ballot question to help fix Michigan’s crumbling roads by raising the sales tax.

Governor Rick Snyder says there is no alternative to pay for repairing Michigan’s crumbling bridges and roads if the tax increase known Proposal 1 fails on the ballot in May. Some critics of the ballot question say the Legislature is trying to pass the buck on to voters rather than doing its job to appropriately fund state departments.

Governor Snyder supports Proposal 1 and has been taking his message to voters throughout the state. He says he understands the ballot question is a big ask.

“When you ask for a tax increase it’s very difficult to begin with,” he says, “but then you get people saying ‘well why don’t you find the money somewhere else?’… We’ve made good faith efforts over four years now to work on that, and there’s not the resources there.”

The Detroit Free Press recently broke down what voters need to know about Proposal 1 in an editorial. The Freep explains:

Question: Michigan motorists already pay a state fuel tax (currently pegged at 19 cents a gallon for gas, 15 cents a gallon for diesel) and a state sales tax (6%) every time they fuel up. Why don’t those taxes generate enough revenue to keep our roads in good repair?

Answer: The fuel tax was last raised almost 20 years ago, so it hasn’t kept pace with the costs of road maintenance, which has increased as fast as most other costs.

We’re also driving fewer miles each year, and we’re driving them in more fuel-efficient vehicles. So any per-gallon tax is doomed to generate less and less revenue as time goes on.

Q: But we also pay sales tax on our fuel purchases. And that tax increases when the price of gas or diesel fuel goes up, doesn’t it?

A: Yes, and sales tax revenues have indeed grown faster than fuel tax revenues.

But virtually none of the sales tax on fuel purchases goes to roads. The state constitution earmarks nearly three-quarters of those revenues for public schools, and another 10% for cities, townships and villages.

The bottom line is that both revenue sources generate about $1.3 billion less each year than Michigan needs to bring most of its roads and bridges to good condition and keep them that way.