Detroit Evening Report: What to know about Proposal L, Detroit’s public library millage renewal

Bre'Anna Tinsley July 29, 2024Listen to the latest episode of the “Detroit Evening Report” podcast.

A proposal to renew a millage for the Detroit Public Library will be on the August 6 ballot for Detroiters.

Subscribe to the Detroit Evening Report on Apple Podcasts, Spotify, NPR.org or wherever you get your podcasts.

Homeowners in the city currently pay $3.99 for every $1,000 of taxable property value.

If approved, Proposal L would not increase taxes — it would just renew the millage already passed in 2014. The renewal would last for the next 10 years.

Christopher Korenowsky, the chief operating officer for the Detroit Public Library, says about 85% of the library’s operating budget is funded by the millage.

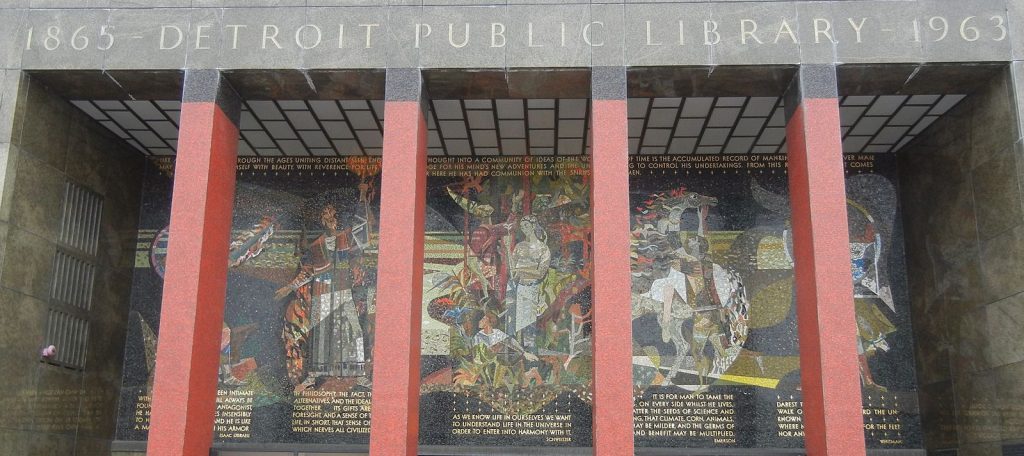

“The vote is really the strongest majority we have of funding, to keep our 21 branches, to keep our mobile library van operating and of course, the historic Main Library in Downtown Detroit all fall under this operational vote,” he said.

Korenowsky said if the proposal doesn’t pass they would have to start shutting down branches.

Still, some voters say they oppose the millage because Proposal L would be subject to what’s known as “tax capture.” The phrase refers to a process where city government can take property taxes from one millage and use it to help pay for other projects.

The Detroit Public Library lost almost $4 million due to tax captures in 2023, and is expecting to surrender more next year. Some Detroiters say they’ll vote no on the library’s tax millage to prevent that from happening.

But if the new millage is approved, that wouldn’t be the case. The city’s Law Department determined in March 2023 that any library millages approved by voters after 2017 would be exempt from tax captures, unlocking an additional $3.2 million for the library in the next fiscal year, starting July 1.

Regardless, Russ Bellant, co-organizer for the group Detroiters For Tax Justice, says opposing Proposal L will do more harm than good.

“Proposal L gives you a very easy way to help perpetuate and supplement the educational capacity in our city. Which is in crisis,” he said. “One simple yes vote puts [a] whole lot on the plate for a lot of people in Detroit.”

Other headlines for Monday, July 29, 2024:

- Developers have broken ground on a new affordable housing project in Corktown.

- The Corktown Business Association launched a campaign last week to “Save the Bricks,” referring to the historic brick paving on Michigan Avenue between the Lodge Freeway and Rosa Parks Boulevard.

- The Detroit Water and Sewerage Department is launching a new payment plan today for customers with overdue bills who don’t qualify as low-income.

Do you have a community story we should tell? Let us know in an email at detroiteveningreport@wdet.org.

Trusted, accurate, up-to-date.

WDET strives to make our journalism accessible to everyone. As a public media institution, we maintain our journalistic integrity through independent support from readers like you. If you value WDET as your source of news, music and conversation, please make a gift today.

“We just literally would not have the funds to operate."

Christopher Korenowsky, Detroit Public Library C.O.O

The millage is expected to generate about 42 million dollars in the first year if it’s renewed. However, the Library won’t see that entire amount.

A Michigan law passed in 1975, and recodified in 2018, allows cities to skim money from property taxes to develop downtown areas. The process is called ‘tax increment funding’ …otherwise known as ‘tax captures.’ City governments can collect money from millages on entities like schools, parks, and public libraires.

Russ Bellant is the co-organizer for the group Detroiters For Tax Justice. He’s also a former member of the Detroit Library Commission. Bellant said residents vote to authorize property taxes, so those funds should only be used in the way that voters approved.

“A private state law allows local officials to take money largely unreported and do as they see fit with little notice to the public, you know its problematic,” Bellant said.

The Detroit Public Library reported it $3.9 million dollars in tax captures in 2023.

Korenowsky says while the institution could benefit from the eliminating tax captures, it’s still able to operate efficiently without that money. And thanks to the library’s budget team, the tax captures have not caught them off guard. They know how much is anticipate to be captured and make allowances for them.

Russ Bellant is against the practice, but he says voting no on Proposal L is NOT the best route to block tax captures and will do more harm than good.

“Proposal L gives you a very easy way to help perpetuate and supplement the educational capacity in our city. Which is in crisis,” Bellant said. “And anything that we take away reduced the future of the children of Detroit, and the people who need library services and culturally benefit from the services across the board.”

"One simple yes vote puts whole lot on the plate for a lot of people in Detroit."

Russ Bellant, Co-Organizer for Detroiters For Tax Justice.

Bellant advises voters to talk to city council about ending tax captures instead of eliminating tax millages all together.

Bellant said the benefits of the libraries far outwey the impact of the tax capture. The library often serves as a resource for civic services like heating and warming centers during extreme weather. The library currently has a “laptop to go” program to help close the digital divide, and even provides a safe space for kids to go after school until their parents get off work.

Korenowsky added that public libraries help build strong neighborhoods, provide support for academic success, and help generate jobs in the communities they serve.

Prop L appears on the August 6th primary election ballot in Detroit.