Detroit Homeowners Have Until Dec. 20th to Get Property Tax Break

The city is hosting workshops for residents to learn how to apply for an income-based property tax exemption.

Update, 11:00 am ET, Dec. 12, 2019: The city has extended the deadline to apply for this exemption to Dec. 20, citing long lines at the City Exemption Division office, according to a press release from the city.

Detroit is giving homeowners a last-minute chance to apply for property tax exemptions.

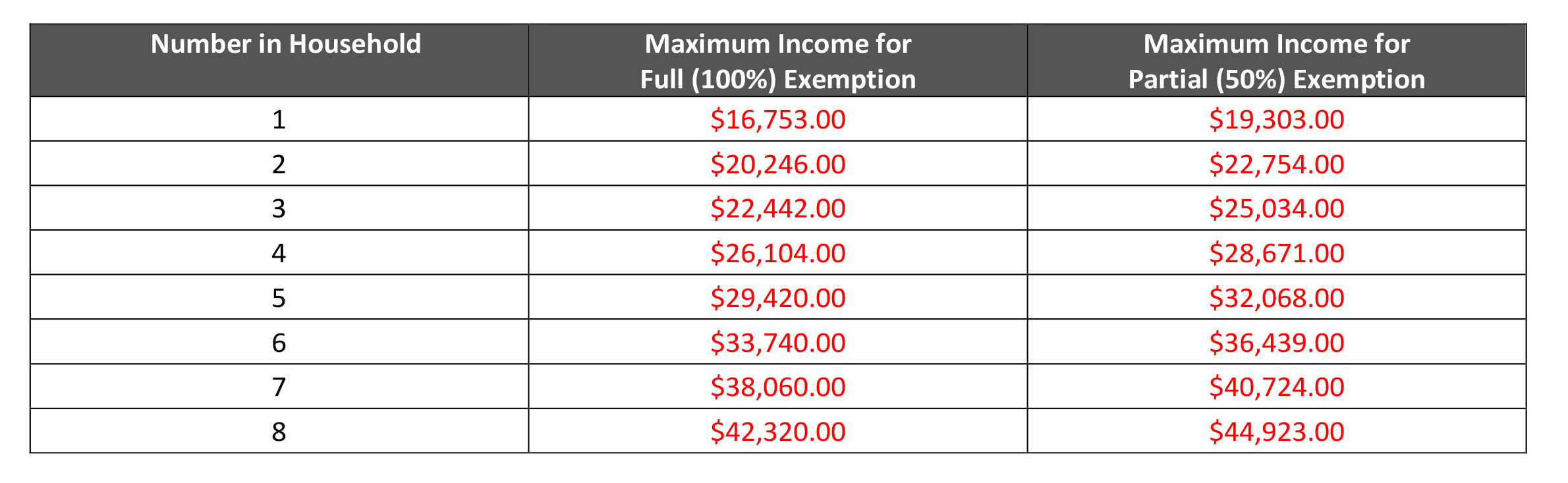

Applicants could get their property taxes cut in half — or eliminated all together — if they meet certain income requirements and apply by this Monday, Dec. 20th.

For instance, a household of four that makes less than $26,000 a year would be exempt from paying any property taxes this year.

To apply, Detroiters will need to submit a Homeowners Property Tax Assistance Program application, proof of home ownership and income tax returns, and proof of residency for minors in order to be considered.

Workshops Available

The city is hosting workshops this weekend for residents to learn how to apply for the tax break. They are:

- Thursday, Dec. 5th, at Central Detroit Christian located at 1550 Taylor St. from 10:00 am – 2:00 pm

- Thursday Dec. 5th at Focus Hope at 1400 Oakman Blvd. from 11:00 am – 3:00 pm

- Friday, Dec. 6h at Southwest Economic Solutions at 2826 Bagley St. from 10:00 am – 2:00 pm

- Saturday, Dec. 7th at Detroit Association of Women’s Clubs at 5461 Brush St. from 10:00 am to 12:00 pm

- Monday, Dec. 9th at Eastside Commiunity Network at 4401 Conner from 2:00 pm to 6:00 pm

- Monday, Dec. 9th at Black Caucus Foundation at 2470 Collingwood St. from 9:00 am – 12:00 pm

- Monday, Dec. 9th at UCHC at 2727 Second Ave. Suite 313, from 9:00 am – 12:00 pm

The exemption only applies to this year’s taxes and does not cover past tax debt or fees.

Wayne County has programs to address those obligations but those efforts have been criticized. A recent report from the Detroit News says one in four Detroiters owe more debt now than they did three years ago, even after joining the county’s payment programs.