Michigan Congress Members Split Along Party Lines Over GOP Tax Plan

U.S. House tax plan, up for vote soon, divides Michigan delegation. Is it a job creator or hit to the middle-class?

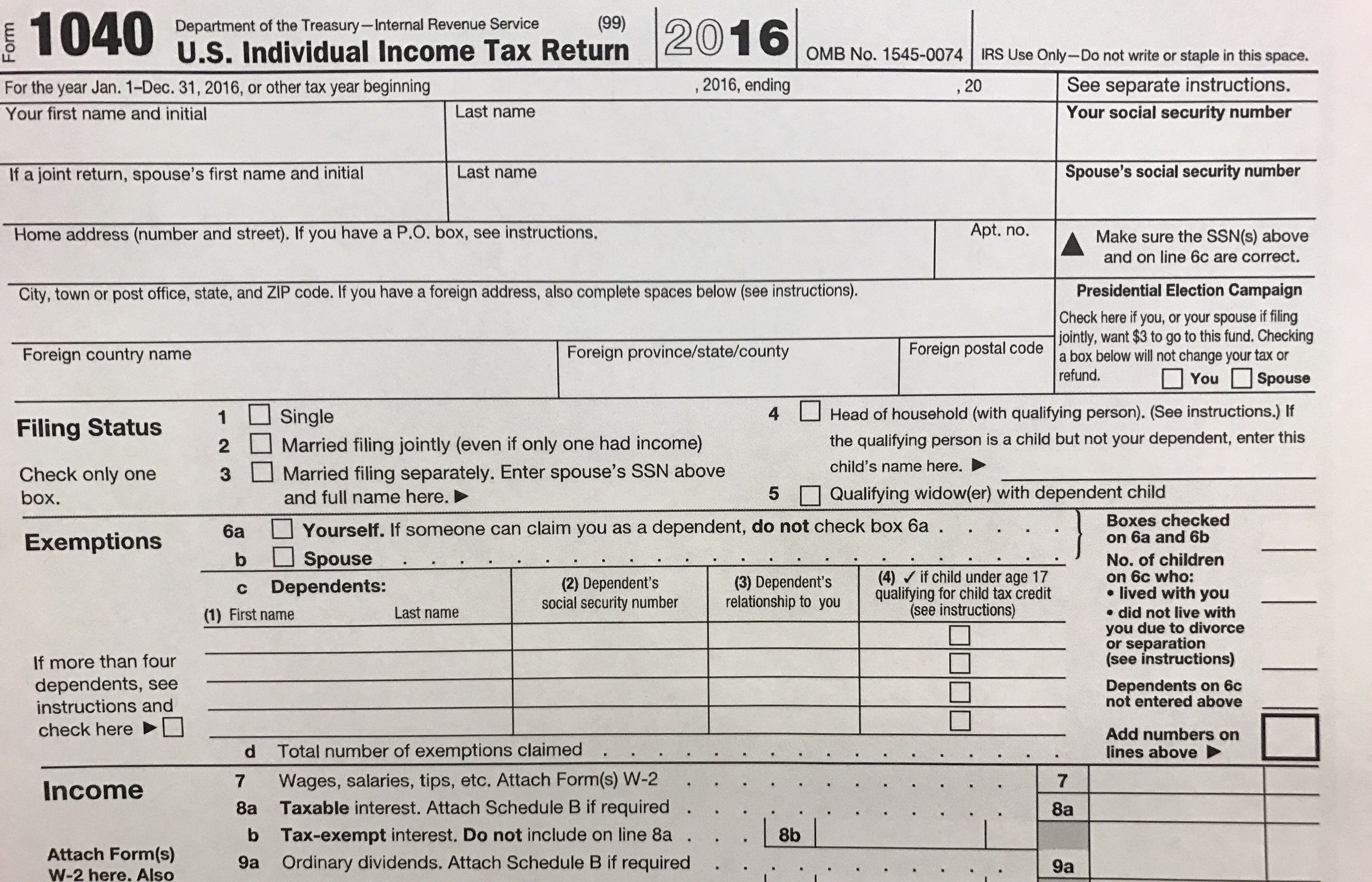

Republicans in the U.S. House are expected to bring their long-sought effort at tax reform up for a vote this week.

And, not surprisingly, the plan is splitting Michigan members of Congress along party lines.

GOP lawmakers are under pressure to enact some kind of significant legislation, particularly after big electoral wins by Democrats in several states last week.

Republicans in Michigan are cheering the restoration of a tax credit for adopting children and an amendment to create a new 9 percent tax rate for some small businesses.

Members like U.S. Rep. Fred Upton (R-St. Joseph) say the new rate will help more firms bring jobs to the state.

Congressman Mike Bishop (R-Rochester) says the reform should pass overwhelmingly unless Democrats put “politics above people.”

But Michigan Democrats counter by citing the nonpartisan Tax Policy Center’s estimate that the plan will raise taxes on almost 40 million working-class families.

Congressman Sander Levin (D-Royal Oak) says the proposal hurts the middle class by reducing credits for itemized medical expenses and interest on student loans.

U.S. Rep. Debbie Dingell (D-Dearborn) says the plan will add at least $1.5 trillion more to the federal deficit.