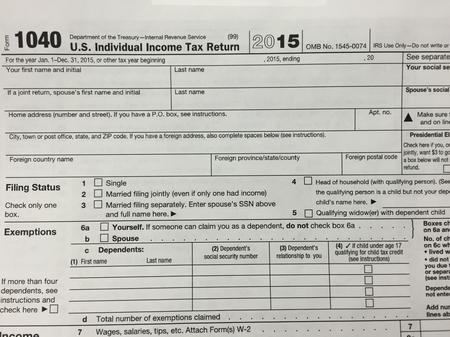

What Would the GOP’s Tax Proposal Mean for You?

“I think one of the first things to consider here is that this is just a plan,” says policy analyst Alan Barber.

Republicans in Congress have unveiled their proposal for tax reform. Among other things, it would reduce the number of tax brackets, it would almost double the standard deduction for individuals and married couples, and it phases out the federal estate tax.

Many Republicans hailed the plan as a great launching off point for conservatives to really overhaul our complex tax structure.

Critics say it would increase the federal deficit with no tangible plan to fill that gap.

Jeffrey Dorfman, professor and economist at the University of Georgia, joins speaks with Detroit Today’s Jake Neher about the GOP tax proposal.

Dorfman, who tends to approach economic issues from a conservative perspective, thinks “there’s more good than bad” when it comes to the tax plan.

“It’s certainly not perfect, but they’re making things simpler,” he says. “A lot of people will be able to file their taxes on a fifteen-line, post card sized, form.”

Overall, Dorfman thinks the tax proposal “didn’t simplify things as much as they could have…but (it’s) a good place to start.”

Alan Barber, director of domestic policy at the Center for Economic and Policy Research, also joins the show to share his thoughts on the pending tax proposal.

Barber is more skeptical about what the GOP unveiled. But he emphasized that the proposal has a long way to go before it could even become a bill.

“I think one of the first things to consider here is that this is just a plan,” says Barber. “It’s the first step towards a tax bill.”

That said, Barber thinks the tax plan ultimately “looks like a huge Christmas gift to the ultra rich and corporations.”

Click on the audio player above for the full conversation.