Think Your Detroit Property Taxes Are Too High?

A Detroit non-profit can help you appeal the assessed value of your home.

Editor’s Note: This story has been updated from a previous version for accuracy.

In Detroit, there is a small window of time each year when homeowners can challenge the assessed values of their properties in hopes of reducing their property taxes. The period this year is February 1 – 15.

A non-profit that launched last April, the Detroit Justice Center, is offering assistance with the appeals process. Legal Director and Staff Attorney for the Center, Desiree Ferguson, says the free service is available to residents who want to make sure they’re being charged the right amount in property taxes. If residents call or email the center, Ferguson says the non-profit will send a legal worker out to their homes.

“Once we have procured market comparables on your home, we will know whether you’ve been over-assessed or not. And if we find that you have been, then we will pursue the appeal on your behalf,” says Ferguson.

The assessed value of a home is involved in the formula that determines property taxes. The Michigan Constitution states that the value cannot be more than 50% of a home’s fair market value. A study published in the Northwestern University Law Review in 2018 by Bernadette Atuahene, Professor of Law, Chicago-Kent College of Law, concluded that after the Great Recession, the City of Detroit illegally assessed 55 – 85% of its residential properties because they were were appraised at values that were more than 50% of recent sales prices. Atuahene found these over-assessments contributed to the high tax foreclosure rate in Detroit.

Mayor Mike Duggan has acknowledged that the city’s property tax assessments were too high for years.

Ferguson says her own home’s assessed value was not properly adjusted after the recession. “I was still paying the same taxes that I had been paying when its value was much higher. To me, that was just not logical. So, I did an appeal and I was successful.” She says the Detroit Justice Center is using the work that she did as a template for how to package appeals for clients.

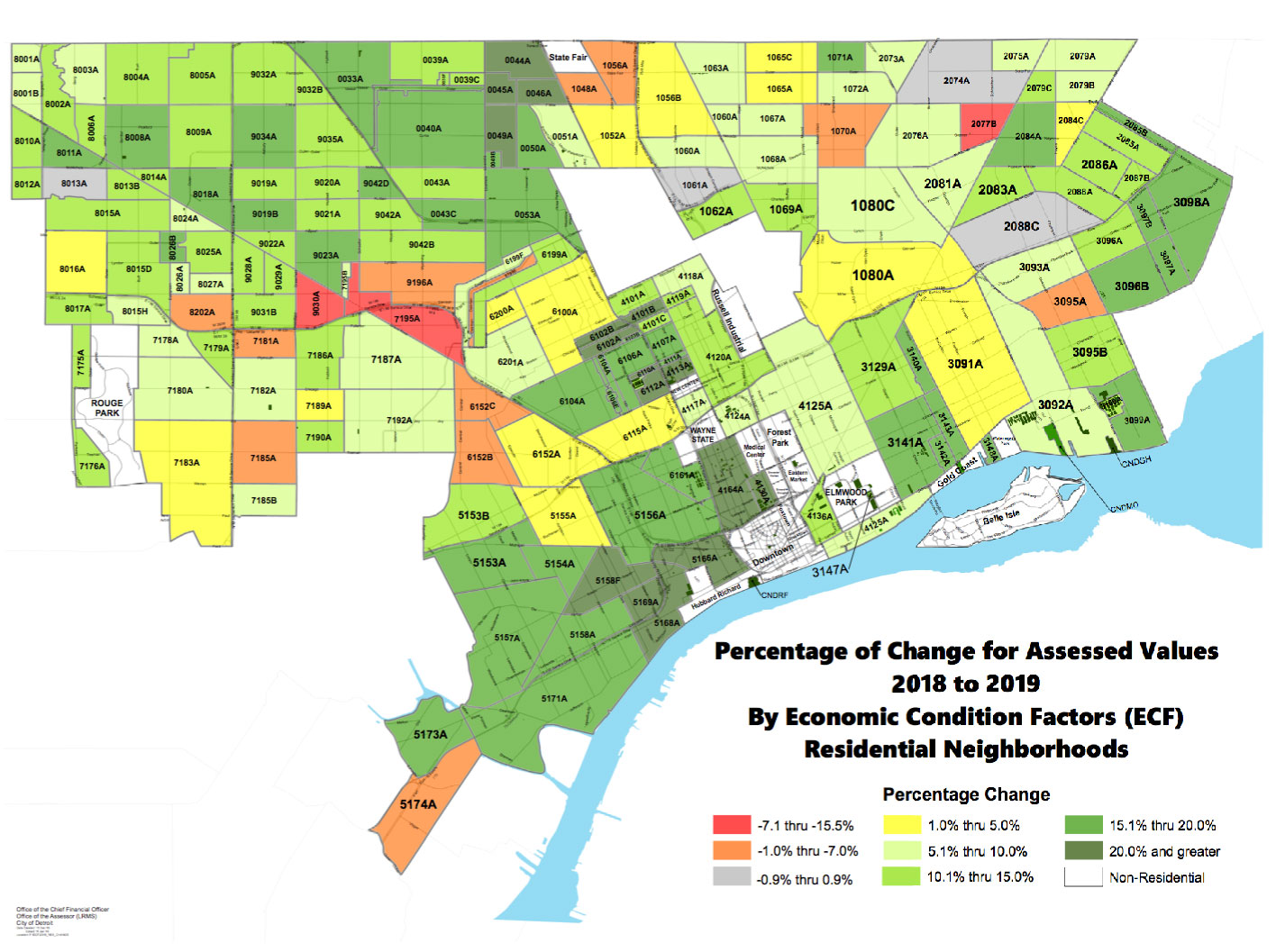

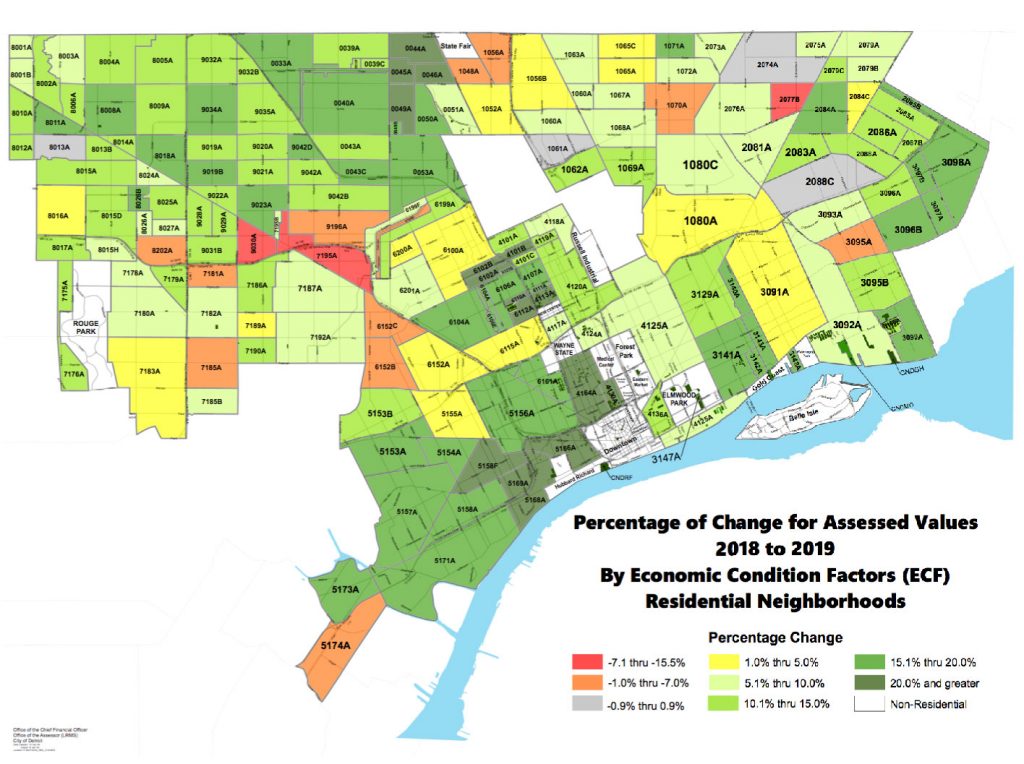

Detroit recently mailed out proposed property assessment changes for 2019. A press release put out January 22 by the city stated, “Citywide, the average increase in residential value was 12%, with several neighborhoods seeing gains of more than 20%… While property values have increases [sic] sharply, property taxes for most will not. Under state law, the annual increase in property taxes is capped at 1.02%. That cap is lifted only when a property transfers. At that time, the taxable amount will adjust to the State Equalized Value the year following the transfer. ” Read the release here.

The Detroit Justice Center will have a representative at the Mary Turner Center for Advocacy, 1927 Rosa Parks Blvd, Suite 110A, Detroit from 10 a.m. to 4 p.m. on Wednesday, January 30. It will also have a presence with the United Community Housing Coalition until January 31 from 8 a.m. to 4 p.m. at the show-cause hearing at 400 Monroe St., Detroit. For more information, residents can call (833) 200-0093 or email clw@detroitjustice.org.