IRS Urges Taxpayers to Review Their Withholding Status [CALCULATOR]

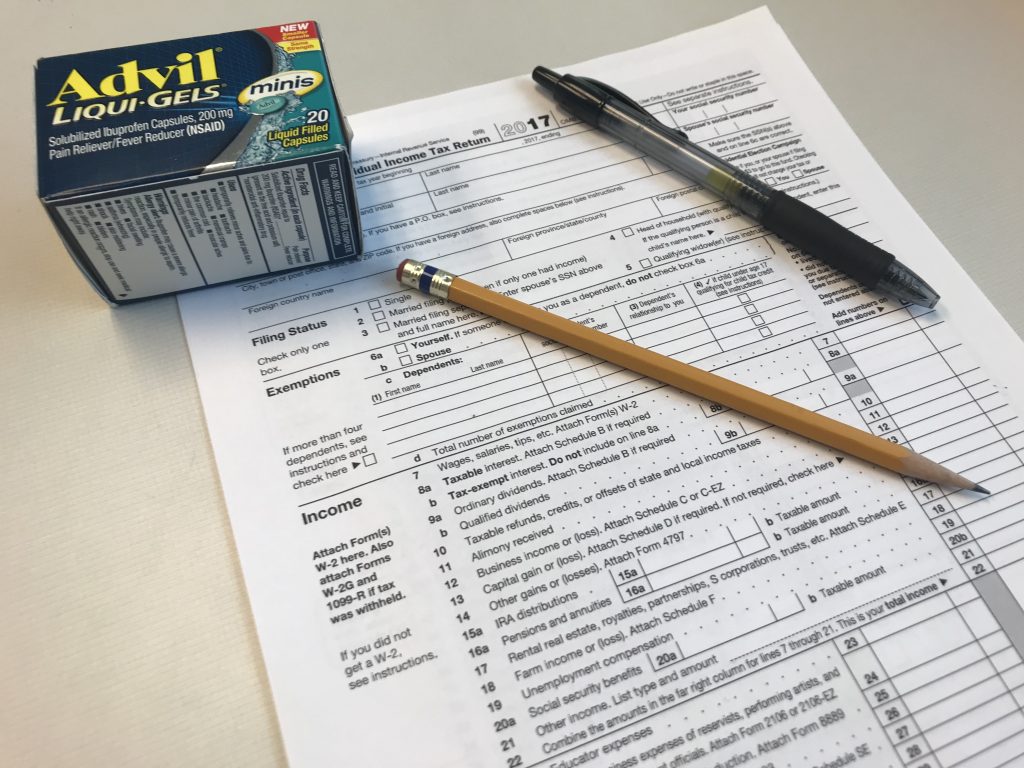

The new U.S. tax law could dictate whether you get a refund next year or end up owing more.

The new tax law Congress passed at the end of 2017 might not affect tax returns filed this year. But it is likely to dictate whether you get a refund next year or end up owing more to Uncle Sam.

Many Americans are seeing more money in their paychecks right now because the U.S. Government is withholding less in income taxes. But the Internal Revenue Service says those who don’t re-examine their withholding status now could end up sending a check to Washington instead of getting money back.

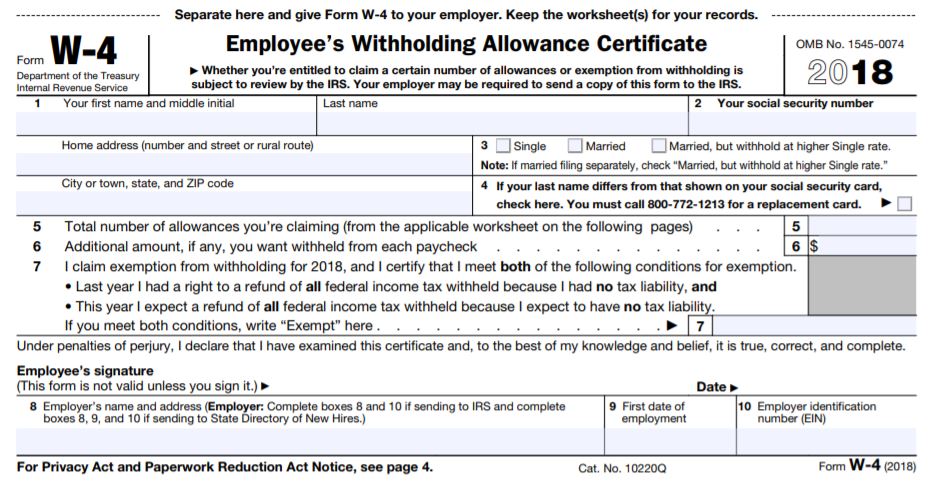

“If you don’t check your withholding, you may end up owing,” says IRS spokesman Luis Garcia. He says a new online calculator will help taxpayers figure out whether the government is withholding too much or too little. Those who want to change their status will have to file updated W-4 forms with their employers.

“A lot of people fill out that form when they start, and they don’t think about it again,” Garcia says.

Calculate your withholding here

Garcia says taxpayers also need to beware of scam artists trying to steal their identities and their money. He says the IRS has done a good job of protecting taxpayers and their financial information.

“We’ve seen a 60 percent decline in identity theft-related tax fraud,” Garcia says. But that doesn’t stop con artists from trying. He says the most sophisticated scams have found a way to get around the government.

Go “phish”

In the latest scam, Garcia says hackers have infected tax preparing offices with a computer virus that enables them to extract a taxpayer’s personal information.

“They know where you work, they know how much you make, they know many dependents you have, their social security numbers, and they put all this information together and file a tax return,” Garcia says. “They even use your same direct deposit account number.”

Once that’s done, Garcia says the scammers contact the recipient of the bogus refund, pretending to represent the IRS or a debt collector, and tell the victim they have to repay the money. Garcia says the IRS will never threaten taxpayers or demand immediate payment, or tell them they have to pay by a specific method.

Click on the audio player to hear the conversation with WDET’s Pat Batcheller.