Deadline for property tax assistance program approaching for Detroit residents

The HOPE program enables low-income households to avoid paying for part or all of their current year’s property taxes.

The deadline for Detroit’s Homeowners Property Exemption (HOPE) program is Dec. 11.

The state-mandated program — formerly called the Homeowners Property Tax Assistance Program — discounts or eliminates property taxes for low-income households that include the property owner.

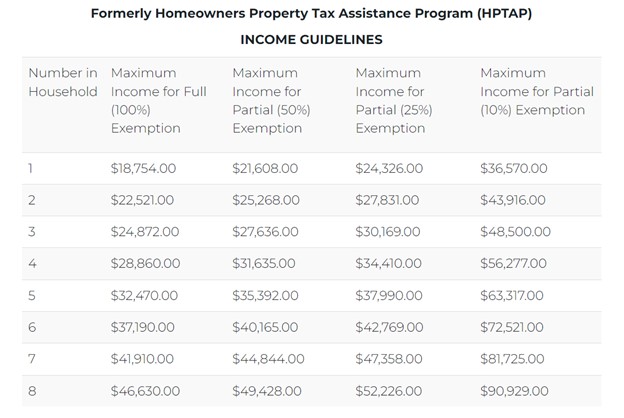

Homeowners can qualify for a 10%, 25%, 50% or 100% reduction in property taxes for the current year’s bill. Eligibility and the percentage vary based on household size and income. A four-person household with an annual income of $28,860 or less is eligible for a full property tax exemption, for example.

Applicants can apply with a paper application or online here, and must submit several forms of documentation including proof of homeownership, government ID’s for all adults, and proof of income for all household members.

“Not providing all the documentation, you’ll end up with an adverse decision,” warns Willie Donwell, the director of Detroit’s property assessment board of review which evaluates the applications.

Listen: Full interview with Detroit’s board of review director on the city’s property tax exemption program

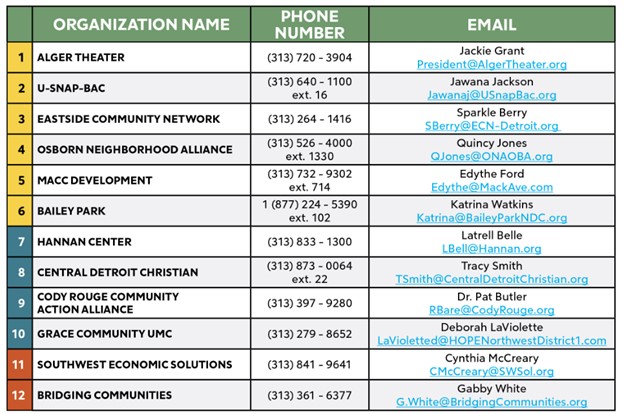

A dozen organizations are available to help property owners apply for the HOPE program. Wayne Metro Community Action Agency is hosting resource days from 9 a.m. to 3:30 p.m. Friday, Dec. 8, and from 9 a.m. to 3:30 p.m. Monday, Dec. 11, at 7310 Woodward Ave., Detroit. Residents can also schedule in-person appointments for assistance here.

“We’re trying to help as many people as possible,” says Donwell. “So please take the time and file now. Don’t wait until the deadline.”

Donwell says in recent years about 18,000 households have applied for the program and approximately 14,000 have received exemptions. Residents who are approved for the HOPE program are also eligible for the Pay As You Stay (PAYS) program, which reduces delinquent Wayne County property taxes.

Trusted, accurate, up-to-date.

WDET strives to make our journalism accessible to everyone. As a public media institution, we maintain our journalistic integrity through independent support from readers like you. If you value WDET as your source of news, music and conversation, please make a gift today.