Michigan Car Insurance Rates Decline by 18% But Are Still the Highest in the Country

Rates went down after reforms from a state law went into effect in July.

Michigan’s auto insurance rates went down 18% in 2020 compared to what they were the previous year. That’s according to a national study from an online insurance comparison website, TheZebra.com.

According to the study, Michigan’s rates went from an average of $3,106 in 2019 to an average of $2,535 in 2020. Insurance rates declined 4% across the country last year, mostly due to less driving during the pandemic. But in Michigan, rates decreased far beyond that by a whopping 18%.

Why Did Michigan’s Rates Go Down So Much?

In July, landmark auto reforms went into effect in Michigan as a result of a state law passed in 2019. The most significant change allowed for Michiganders to opt out of paying for unlimited lifetime medical benefits on their car insurance bill – a requirement that was unique to Michigan. While this Personal Injury Protection (PIP) as it’s called is still the default coverage, residents with adequate health insurance can now stop paying for medical coverage on their car insurance bill if they take steps to opt out.

PIP medical coverage accounts for nearly half of the costs of an auto insurance bill, so the ability to stop paying for it means huge potential savings for Michigan drivers. Many had already seen an impact when WDET checked in back in September. Warren resident Madison Poteat says she went from paying $745 a month for two vehicles to $285 a month, without even switching insurance companies.

Another Warren resident, Holly McCleary, says she went from $965 a month for three cars to $653 a month after removing PIP coverage. In total, WDET’s unscientific survey of about 20 people in September found that drivers on average saved $174 a month, or 33% off of what they had previously paid. Now the study by TheZebra.com backs up the finding that the law has led to savings for Michigan drivers and the state is encountering similar findings.

“The report validates what the Department of Insurance and Financial Services (DIFS) has seen in approved rate filings, that drivers who want to save money now have options for lowering their costs,” says DIFS Director Anita Fox.

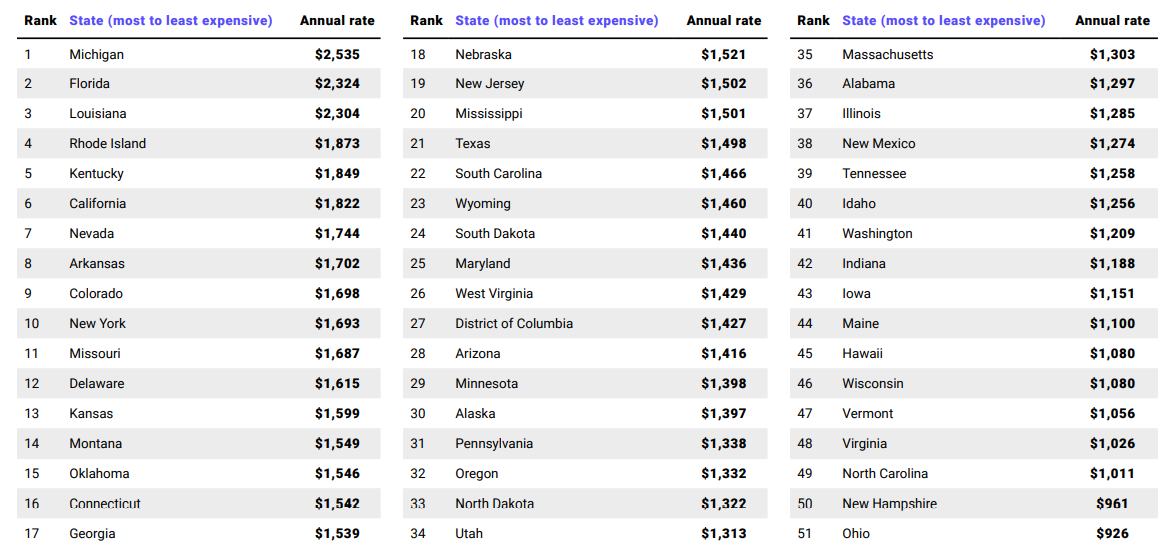

Car Insurance Rates by State

Michigan’s Auto Insurance Rates Are Still the Highest

Despite the sizable decline, at $2,535 Michigan’s rates are still the highest in the country (Detroit was the most expensive city at $5,072). The average car insurance nationwide costs $1,483, and the cheapest in the U.S. is in nearby Ohio where residents on average pay $926.

Part of the reason why Michigan’s insurance is still so high is that some people, those without adequate insurance, are still not eligible to opt out of paying for PIP. Others who are eligible may not realize they can make the change or know how to do so. To opt out, drivers have to prove that they have qualified health insurance and sign a special form for their insurance company. This must be done every time the customer’s policy renews, typically every 6 months.

Still, some drivers are aware that they can opt out of paying for medical coverage on their car insurance but they are choosing to keep it. Take Clinton Township resident Rainy Lahaie. In September she told WDET, “It’s priceless to me.”

As a nurse, Lahaie says she’s seen up-close the benefits of PIP, that it picks up where health insurance can leave off and can cover lengthy hospital stays, pay for top-notch rehabilitation services and wheelchair ramp installation when necessary. Lahaie recognizes the odds of her getting in a catastrophic car crash and needing these services are slim, but she says for her it’s not worth the gamble.

Trusted, accurate, up-to-date

WDET is here to keep you informed on essential information, news and resources related to COVID-19.

This is a stressful, insecure time for many. So it’s more important than ever for you, our listeners and readers, who are able to donate to keep supporting WDET’s mission. Please make a gift today.