Tax Time Is Coming; What’s New for 2019 [BOOKLET + CALCULATOR]

You might not have to itemize, but you might want to change your withholding.

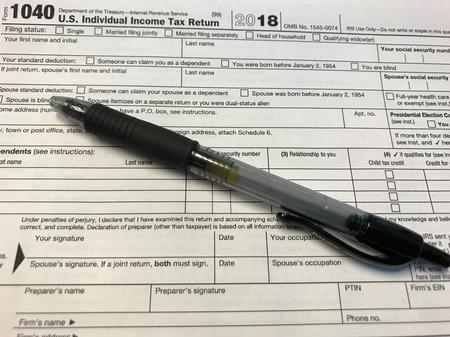

Last Christmas, Congress gave U.S. corporations a big tax break as part of an overhaul of the nation’s tax code. But it also made changes that should make filing your income taxes a little easier. For one thing, it simplified the individual income tax return, Form 1040, and eliminated two other returns, the 1040-A and 1040-EZ. Now, most Americans will use the same form when submitting their 2018 income taxes to the Internal Revenue Service.

The tax code rewrite also raised the standard deductions to $12,000 for single filers and married couples filing separately, $24,000 for couples filing jointly, and $18,000 for heads of households. IRS spokesman Luis Garcia says in most cases, people won’t need to itemize their deductions.

“The vast majority of people are under that limit, so there’s no need to fill out all this information,” Garcia says.

Simple, right?

Not quite. Garcia says if you do itemize, you’ll need to show your work, especially if you’re trying to write off charitable contributions.

“What you want to do is make sure you have proof of your contribution,” Garcia says, such as a canceled check or a receipt for cash donations.

“It’s no longer the case where you gave cash and say, ‘this is what I gave,’ and we take your word for it.”–Luis Garcia, Internal Revenue Service.

What about my refund?

Another change in the tax law could affect whether you get a refund. Depending on what your tax rate is, the government may be taking less money out of your paycheck. That could mean you’ll end up owing the IRS something come April. Instead of getting a check from Uncle Sam, you’ll be writing one to him. Garcia says if you haven’t changed the withholding on your W-2 form in a few years, now would be a good time to consider it.

“The people who are always used to getting a refund may find out they’re not going to get a refund, or in fact, that they owe.”

The IRS has a tool on its website where you can figure out what your withholding should be from now on, and adjust it on your W-2.

Calculate your withholding here.

Garcia says the IRS is constantly trying to stay ahead of internet con artists and hackers who might try to steal your personal information and your refund, or phone scammers who try to trick you into giving them money. He says one way to tell if you’re being duped is if someone pretending to be with the IRS asks you to submit a specific form of payment. Here’s a clue: the IRS does not accept iTunes cards.

“If somebody says that they’re from the IRS and that you have to pay by this method, whether it’s a certain kind of debit card or a gift card, that’s a big red flag,” Garcia says. He also says the IRS rarely calls taxpayers directly, but when it does, he says no one will threaten you or demand immediate payment.

Click on the audio player to hear the conversation with WDET’s Pat Batcheller.

IRS Tax Primer on Scribd