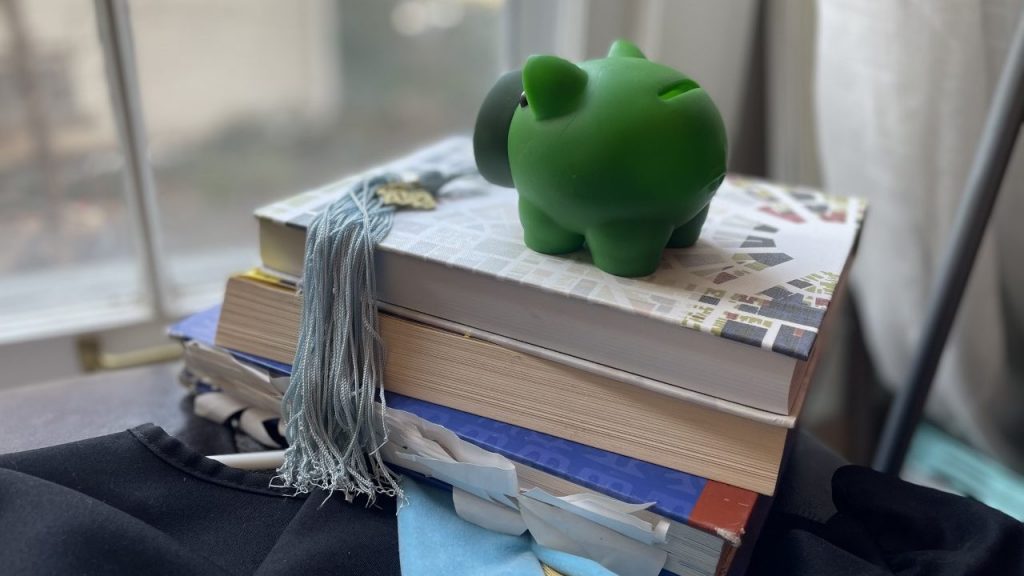

Detroit Evening Report: Michigan residents won’t be taxed on student loan forgiveness through 2025

Nargis Rahman September 28, 2022An estimated 1.4 million Michiganders have student loans.

Michigan Governor Gretchen Whitmer announced a student relief program for 1.4 million Michigan residents. The Public Service Loan Forgiveness program will allow residents to receive debt relief without having to bill it as taxable income for loan forgiveness. Usually when debt is forgiven the IRS taxes the money.

Whitmer says it’s an effort to make higher education more affordable. The state says the program is possible because of the American Rescue Plan. Students who receive loans between 2021 and 2025 are also eligible.

“Tax-free student loan forgiveness could benefit up to 1.4 million Michiganders and help keep money in their pockets,” said Gov. Gretchen Whitmer. “Michigan PSLF recipients who serve their community will not be taxed for any amount of student loan relief they have received. In Michigan, we value the hard work that all our citizens put in to get the education they need. I will work with anyone to keep lowering the cost of higher education and help students not go into debt in the first place.”

Some requirements for the Public Service Loan Forgiveness program are residents who work in public service, qualifying nonprofits and government agencies

As of July, 7,000 Michigan residents had $406 million in loans forgiven under the plan.

New applicants can apply at studentaid.gov by October 31.

Other headlines for September 28, 2022:

- City of Detroit hosting Skills for Life job fair

- Mark Twain School for Scholars opening new STEAM lab

- Documentary raising prostate cancer awareness in Black men screening in Detroit Friday

Photo Credit: Jake Neher, WDET

Trusted, accurate, up-to-date.

WDET strives to make our journalism accessible to everyone. As a public media institution, we maintain our journalistic integrity through independent support from readers like you. If you value WDET as your source of news, music and conversation, please make a gift today.

Author

-

Nargis Hakim Rahman is the Civic Reporter at 101.9 WDET. Rahman graduated from Wayne State University, where she was a part of the Journalism Institute of Media Diversity.

Nargis Hakim Rahman is the Civic Reporter at 101.9 WDET. Rahman graduated from Wayne State University, where she was a part of the Journalism Institute of Media Diversity.