Activists and Politicians Ask Detroit Mayor Mike Duggan to Reassess Property Tax Foreclosures

Many of the 100,000 foreclosures over the past decade were due to over-assessed taxes.

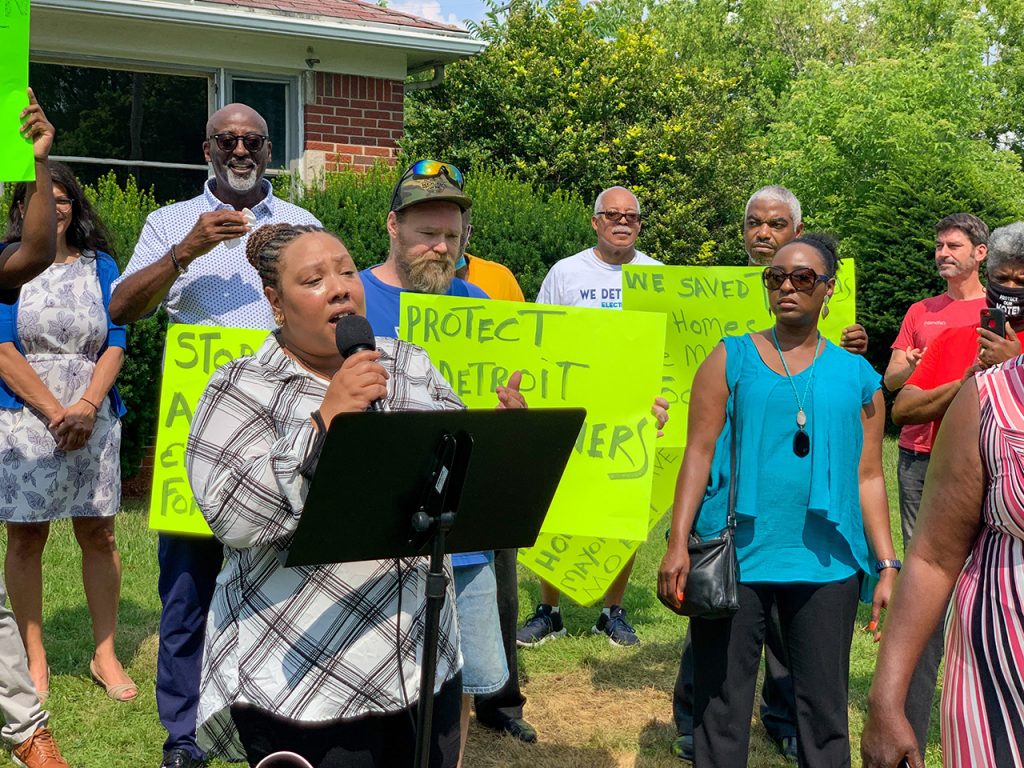

Activists and politicians are calling for an end to tax foreclosures and over-assessments in the City of Detroit.

Sonja Bonnett lost her home to foreclosure and turned that anger into action. She’s director of the Dignity Restoration housing program for the Coalition for Property Tax Justice (CPTJ). At a Wednesday news conference on the city’s east side, Bonnett cited an investigation by The Detroit News and Reveal she says should force Detroit Mayor Mike Duggan to make amends.

“They’re taking advantage of the citizens of Detroit. They’re bleeding us dry. They’re moving us out of our homes that we’ve been in for generations.” –Joe Bates, Detroit homeowner

“100,000 Detroiters were illegally foreclosed upon. $600 million. And what you have to say is the money is gone. We don’t know the old money, baby. We’ll take the new money.”

Detroiter Joe Bates’ home had been in his family for over a century when the city took it for non-payment of taxes. He says a private company bought it and then sold it back to him at a profit — in a process Bates says is predatory.

“They’re taking advantage of the citizens of Detroit. They’re bleeding us dry. They’re moving us out of our homes that we’ve been in for generations.”

Under state law, Bates should not have had to pay property taxes since his income was below the poverty line.

U.S. Rep. Rashida Tlaib (D-Detroit) wants people held accountable. “Detroit’s illegally inflated property taxes have caused the greatest number of foreclosures since the Great Depression, overcharging homeowners $600 million in property taxes.”

Professor Bernadette Atuahene with the Coalition for Property Tax Justice says Detroiters who lost their homes should be reimbursed.

“Because you can’t just be illegally inflating people’s property taxes, taking people’s houses telling ’em ‘Oops, I’m sorry.’ We don’t need no oops, we need compensation.”

Her research backs that up, but not all agree.

The Duggan Administration counters that a 2017 citywide reassessment fixed the problem.

Detroit City Council President Pro Tem Mary Sheffield doesn’t buy that. “We have facilitated several meetings with the state tax commission, the assessor’s office, the coalition (CPTJ) demanding that the [Duggan] administration revisit and look at how we are calculating these assessments for the lower value homes.”

Bonnett says there are two successful programs that help residents who believe they are paying too much in taxes. One through the Detroit Justice Center, and another through CPTJ. “We have been 100% successful for three years. We have gotten every client’s we’ve come in contact with assessment lowered.”

Trusted, accurate, up-to-date

WDET is here to keep you informed on essential information, news and resources related to COVID-19.

This is a stressful, insecure time for many. So it’s more important than ever for you, our listeners and readers, who are able to donate to keep supporting WDET’s mission. Please make a gift today.