Detroit Bonds to be Sold with “A” Rating

Detroit’s post-bankruptcy bonds to be re-sold with “A” rating from Standard & Poor’s.

The Standard and Poor’s agency is rating some Detroit bonds as investment grade, specifically the $245 million in exit financing issued last year as part of bankruptcy proceedings.

The rating agency assigned the “A” rating largely based on a new Michigan law that pledges Detroit’s income tax revenue to secure the bonds for investors. Barclay’s Capital currently holds the bonds, and the city pays a variable interest rate.

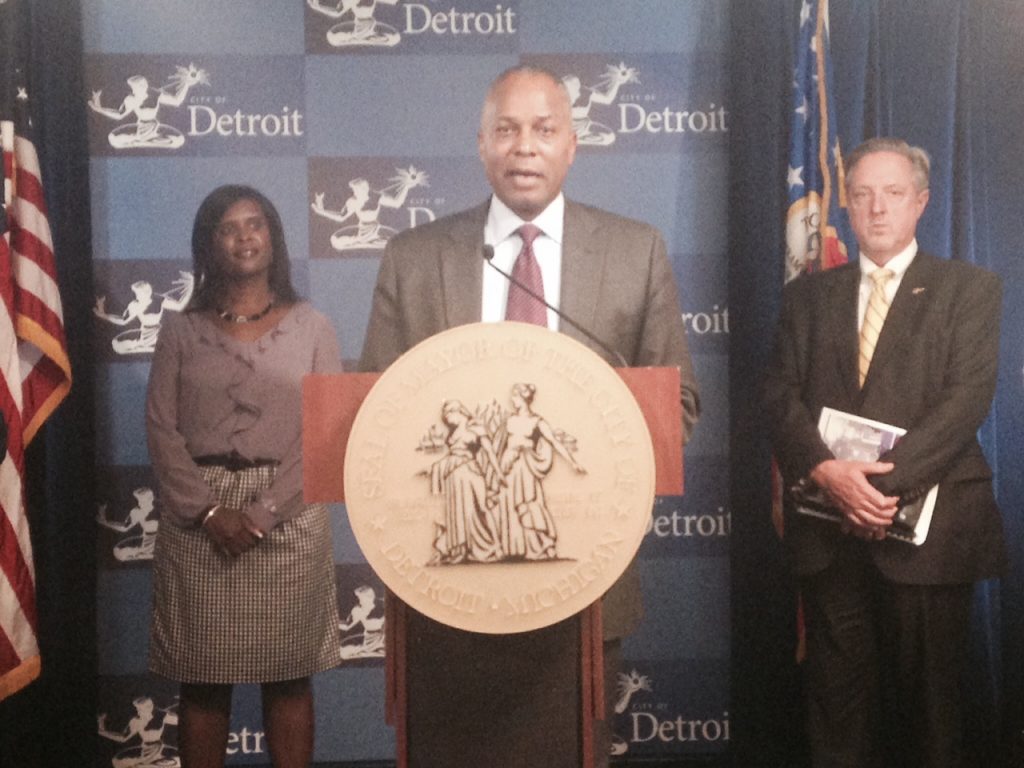

Next month the bonds will be re-sold to private investors on the municipal bond market with a fixed interest rate, which hasn’t yet been determined, says City Finance Director John Naglick. The “A” rating will save the city an estimated $2.5 million annually, he says.

“Those sophisticated investors look to this underlying rating to determine what interest rate they’ll accept,” Naglick says.

Detroit’s Chief Financial Officer John Hill says the Standard & Poor’s report recognizes the city’s financial management has improved.

“It certainly means that there is an outside independent party who has looked at our finances, and has looked at the bond issuance that we have outstanding and the one we are about to go forward with, and has said there’s been improvement in the finances and also improvement certainly from our outlook being stable,” Hills says. “I think that it does give some confidence that the city is improving and that we have turned the corner with respect to those ratings.”

The rating agency also assigned the city an overall investment rating: a “B” which is up from a “D” the month before the bankruptcy was filed.

Mayor Mike Duggan says the constant improvement should be noted. “It seemed like year after year all you heard of was bigger deficits and declining credit ratings. Today what you have is a balanced budget, less borrowing, a lower interest price and a six-step jump in our credit rating.”

The exit financing bonds are scheduled to be sold on August 19th.

Standard & Poor's Report on Detroit