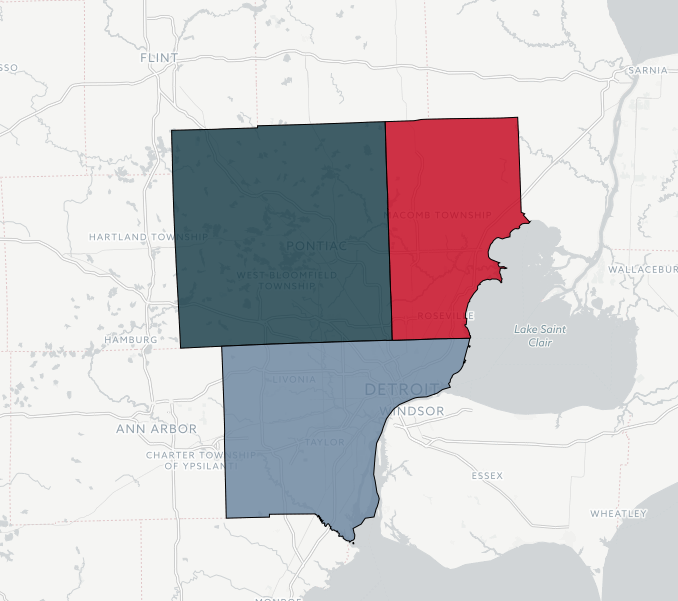

Suburban Elections Results

Check in here for the latest results from Tuesday’s local elections in metro Detroit.

Below are results for contested suburban mayoral races and ballot proposals. Sources: Macomb, Oakland and Wayne County Clerks.

WAYNE COUNTY

OAKLAND COUNTY

MACOMB COUNTY

WAYNE COUNTY

Mayor of Dearborn

Mayor of Dearborn Heights

Garden City Ballot Proposal

Mayor of Gibraltar

Grosse Ile Township Ballot Proposal

Millage Renewal to Maintain Current Police Department Operations: Shall the expired previously voted increase be renewed in the total tax limitation imposed under Article IX, Section 6 of the Michigan Constitution in Grosse Ile Township, of 1.00 mill ($1.00 per $1,000 of taxable value), reduced to .9983 mills ($.9983 per $1,000 of taxable value) by the required millage rollbacks, be renewed at .9983 mills ($.9983 per $1,000 of taxable value) and levied for a period of five (5) years from 2017 through 2021 inclusive, to provide funds for the purpose of maintaining the current law enforcement operations on Grosse Ile, specifically for Police Department Funds, raising an estimated $588,000 in the first year the millage is approved and levied?

Mayor of Grosse Pointe

Mayor of Grosse Pointe Farms

Mayor of Hamtramck

Southgate Ballot Proposal

Proposal R: City of Southgate City Charter Amendment For Parks And Recreation Millage: Shall Article 7 of the Charter of the City of Southgate, Michigan, be amended to add a new Section 120a which shall provide as follows: Section 120a the City Council shall be authorized to assess an additional ad valorem tax in an amount not to exceed one (1) mill for five (5) years from July 1, 2018 through June 30, 2023 for the purpose of providing funding specifically dedicated to parks and recreation improvements?

Mayor of Westland

Garden City Public Schools

Operating Millage Renewal Proposal: This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its revenue per pupil foundation allowance and renews millage that will expire with the 2018 tax levy. Shall the currently authorized millage rate limitation of 19.8320 mills ($19.8320 on each $1,000 of taxable valuation) on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in Garden City Public Schools, Wayne County, Michigan, be renewed for a period of 5 years, 2019 to 2023, inclusive, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and 18 mills are levied in 2019 is approximately $2,944,272 (this is a renewal of millage that will expire with the 2018 tax levy)?

Gibraltar School District

School Improvement Bond Proposition: Shall the Gibraltar School District, County of Wayne, State of Michigan, borrow the principal sum of not to exceed Twenty-Four Million Four Hundred Five Thousand Dollars ($24,405,000) and issue its general obligation unlimited tax bonds, in one or more series, for the purpose of paying the cost of the following projects:

· Remodeling, equipping, furnishing, reequipping and refurnishing school buildings and other facilities to enhance safety and security and for other purposes;

· Acquiring and installing technology infrastructure and equipment in school buildings;

· Constructing, furnishing and equipping an addition to a school building; and

· Preparing, developing and improving sites at school buildings and other facilities?

Lincoln Consolidated Schools

Operating Millage Renewal Proposal: This proposal will allow the school district to continue to levy the statutory rate of not to exceed 18 mills on all property, except principal residence and other property exempted by law, required for the school district to receive its revenue per pupil foundation allowance and renews millage that will expire with the 2018 tax levy. Shall the currently authorized millage rate limitation of 18.2105 mills ($18.2105 on each $1,000 of taxable valuation) on the amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, in Lincoln Consolidated School District, Washtenaw and Wayne Counties, Michigan, be renewed for a period of 6 years, 2019 to 2024, inclusive, to provide funds for operating purposes; the estimate of the revenue the school district will collect if the millage is approved and 18 mills are levied in 2019 is approximately $2,566,000 (this is a renewal of millage that will expire with the 2018 tax levy)?

Millage Renewal Proposal To Provide Funds To Operate A System Of Public Recreation And Playgrounds: This proposal will allow the school district to continue to levy public recreation millage previously approved by the electors that will expire with the 2018 levy. Shall the currently authorized millage rate limitation of 0.0986 mill ($0.0986 on each $1,000 of taxable valuation) on the amount of taxes which may be assessed against all property in Lincoln Consolidated School District, Washtenaw and Wayne Counties, Michigan, be renewed for a period of 6 years, 2019 to 2024, inclusive, for the purpose of providing funds for operating a system of public recreation and playgrounds; the estimate of the revenue the school district will collect for such recreation program if the millage is approved and levied in 2019 is approximately $79,816 (this is a renewal of millage that will expire with the 2018 tax levy)?

Northville Public Schools

Bonding Proposal: Shall Northville Public Schools, Wayne, Oakland and Washtenaw Counties, Michigan, borrow the sum of not to exceed One Hundred Four Million Eight Hundred Fifty Thousand Dollars ($104,850,000) and issue its general obligation unlimited tax bonds therefor, in one or more series, for the purpose of: erecting, furnishing, and equipping additions to and remodeling, furnishing and refurnishing, and equipping and re-equipping school facilities; acquiring and installing instructional technology in school facilities; purchasing school buses; and erecting, furnishing, equipping, developing, and improving playgrounds, sites, and athletic fields and facilities?

Romulus Community Schools

Operating Millage Renewal Proposal: This proposal will allow the school district to levy a reduced number of mills previously authorized to be levied on all property, except property exempted by law and renews hold harmless millage that expired with the 2016 tax levy.Shall the total limitation on the hold harmless mills used for operating purposes which may be assessed against all property, except property exempted by law, in Romulus Community Schools, Wayne County, Michigan, be increased by 2.5 mills ($2.50 on each $1,000 of taxable valuation) for a period of 10 years, 2017 to 2026, inclusive; the estimate of the revenue the school district will collect from hold harmless taxes authorized herein if the millage is approved and levied in 2017 is approximately $870,000 (this is a renewal of 2.5 mills out of 5.1314 previously authorized millage that expired with the 2016 tax levy)?

Sinking Fund Millage Proposal: Shall the limitation on the amount of taxes which may be assessed against all property in Romulus Community Schools, Wayne County, Michigan, be increased by and the board of education be authorized to levy not to exceed 3 mills ($3.00 on each $1,000 of taxable valuation) for a period of 10 years, 2018 to 2027, inclusive, to create a sinking fund for the purchase of real estate for sites for, and the construction or repair of, school buildings, for school security improvements, for the acquisition or upgrading of technology and all other purposes authorized by law; the estimate of the revenue the school district will collect if the millage is approved and levied in 2018 is approximately $2,300,000?

Taylor Public Schools

Operating Millage Renewal Proposal: This proposal, if approved by the electors, will allow the Taylor School District to continue to levy the number of operating mills required for the School District to receive revenues at the full per pupil foundation allowance permitted by the State of Michigan. Shall the limitation on the total amount of taxes which may be assessed against all property, except principal residence and other property exempted by law, situated within the Taylor School District, County of Wayne, State of Michigan, be renewed as provided in the Michigan Constitution, in the amount of 18 mills ($18.00 on each $1,000 of taxable valuation), for a period of ten (10) years, 2018 to 2027, inclusive with the 18 mills being a renewal and continuation of an authorized millage which would otherwise expire on June 30, 2018? This operating millage if approved and levied, would provide estimated revenues to the School District of Eleven Million Nine Hundred Eighty-Eight Thousand Two Hundred Sixty-Nine ($11,988,269) Dollars during the 2018 calendar year, to be used for general operating purposes.

OAKLAND COUNTY

Clawson Ballot Proposal

Sidewalk Improvement Bond Proposal: Shall the City of Clawson, Michigan, borrow the sum of not to exceed Two Million One Hundred Twenty-Five Thousand Dollars ($2,125,000) and issue its general obligation unlimited tax bonds, in one or more series payable in not to exceed ten (10) years from the date of issuance, for the purpose of paying the costs to acquire, construct and improve sidewalks in the City, including all related appurtenances? The estimated millage to be levied in 2018 is 0.28 mills ($0.28 per $1,000 of taxable value) and the estimated simple average annual millage rate required to retire the bonds is 0.58 mills ($0.58 per $1,000 of taxable value).

Keego Harbor Ballot Proposals

Charter Amendment 1 Dedicated Police Millage: An amendment to Section 11.5 of the City Charter to add Section 11.5(a) to authorize the levy of 4.0 mills for police purposes for the years 2018 to 2026. This amendment authorizes the annual levy of not to exceed 4.0 mills for 8 years, 2018 to 2026, for police purposes. Approval would increase the tax levy by 4.0 mills as new additional millage in excess of the limitation imposed by law, restoring a portion of the Charter millage authorization previously approved by the electors, since reduced by the Headlee amendment. If levied, 4.0 mills would raise approximately $369,106.00 when first levied in 2018. Approximately $40,344.00, will be required to be distributed to the Tax Increment Finance Authority. Shall this proposed amendment be adopted?

Property Seizure and Forfeiture: Section 18.7. Property Seizure and Forfeiture. As used in this section, “property” shall be liberally construed to include assets and possessions; “employee” includes anyone acting under the authority of the city. A conviction of a criminal offense is a prerequisite to forfeiture and the transfer to the City of Keego Harbor of title to property directly used in or derived from that offense. All revenues from forfeited property, including revenue derived from sharing proceeds of forfeited property from cooperation with other federal, state, or local agencies, shall be placed in a separate fund, used only to pay costs directly related to local street repair, and shall not be earmarked or allocated to law enforcement or code enforcement. At any time, a property owner may ask the City or a court to return property that was wrongly seized or because there is no reason for the City to continue to hold the property. No bond shall be required on any property seized under authority of the city. If property is wrongfully seized, the City has no reason to continue to hold the property, or the property owner is not convicted of a criminal offense that has a forfeiture provision, the city shall return, replace, or provide full compensation for any property damaged, defaced, or devalued as a result of seizure by city employees. Records of all property seizures shall be indexed by date, department, name of owner, property type, and seizure value, and include details of the conviction. These records shall be published monthly on the city’s publicly-accessible website consistent with Michigan’s Freedom of Information Act 442 of 1976.

Lathrup Village Ballot Proposal

Petition Initiated Charter Amendment To Add Section 17.14 Property Seizure and Forfeiture: Shall the City of Lathrup Village Charter be amended to add a new Section 17.14 providing that a criminal conviction is required before forfeiture of any property to the City; that all revenues from forfeited property in connection with any crime must be used solely for street repairs and may not be used for law or code enforcement purposes; that a property owner may seek the return of forfeited property and the City must return, replace, or pay compensation for such property under certain circumstances; and that the City must keep records of forfeited property and publish such records monthly.

Mayor of Novi

Pleasant Ridge Ballot Proposal

Mayor of Pontiac

Mayor of Royal Oak

Royal Oak Ballot Proposals

Mayor of South Lyon

Mayor of Southfield

Troy Ballot Proposal

Mayor of Walled Lake

Avondale School District

- constructing additions to and remodeling of School District buildings, and other facilities, including technology, energy conservation and security improvements;

- acquiring and installing technology infrastructure, improvements and equipment in School District buildings;

- equipping, furnishing, reequipping and refurnishing School District buildings and purchasing school buses;

- and improving, developing and preparing sites, including playgrounds and outdoor athletic fields, facilities and structures, in the School District?

Farmington Public School District

The Lamphere Schools

Madison School District

Northville Public Schools

Oxford Community Schools

Sinking Fund Millage Proposal: Shall the limitation on the amount of taxes which may be assessed against all property in Oxford Community Schools, Oakland and Lapeer Counties, Michigan, be increased by and the board of education be authorized to levy not to exceed .75 mill ($0.75 on each $1,000 of taxable valuation) for a period of 5 years, 2018 to 2022, inclusive, to create a sinking fund for the construction or repair of school buildings, for school security improvements, for the acquisition or upgrading of technology and for all other purposes authorized by law; the estimate of the revenue the school district will collect if the millage is approved and levied in 2018 is approximately $801,000?

Royal Oak Schools

Troy School District

MACOMB COUNTY

Mayor of Center Line

Fraser Ballot Proposal

Mayor of Memphis

Mayor of Mount Clemens

Mayor of New Baltimore

Mayor of Sterling Heights

Armada Area Schools

Center Line Public Schools

Warren Woods Public Schools