When $40,000 a Year is Not Enough

Jessie Robinson struggles to make ends meet every day on a salary of $40,000.

ALICE—Asset-Limited, Income-Constrained, Employed—is a United Way report about just what income levels are needed to live comfortably in each of Michigan’s counties and cover the costs of food, housing, child care, transportation and health care.

Jessie Robinson is part of the ALICE population (see more on our ALICE coverage here). She spoke with WDET’s Sandra Svoboda about her household and her budget.

What does it mean to be an ALICE community member?

Well, it’s a struggle to get by on a daily basis, basically. It’s sounds like a technical term for what I live on an everyday basis. For me personally, it started about three years back. My husband was in a terrible car accident that caused some disability, and over the year after his disability we struggled because we were on one income.

I was paying a COBRA for insurance, because I had taken a new job just before he had got into the accident, which did not have insurance available, and in that time we accumulated quite a bit of medical debt, and it’s just been almost impossible to catch up from that time. So we struggle on a daily basis as to which bills to pay, what bills not to pay. We have one car, and it’s an old car so sometimes we have to struggle with trying to figure out how to get the car upkeep done, and just regular paying rent and living on a daily basis.

Tell me about you and your husband, your educational and professional backgrounds.

Both of us have advanced degrees and both of us have been working professionals for years. My husband actually has a doctorate and I have a bachelor’s degree. He is unable to work full-time anymore due to the disabilities and is still going through a lot of surgeries. In the last year he’s had 11 surgical procedures. So it makes it a little bit difficult for it to be full time employed.

And what is your job?

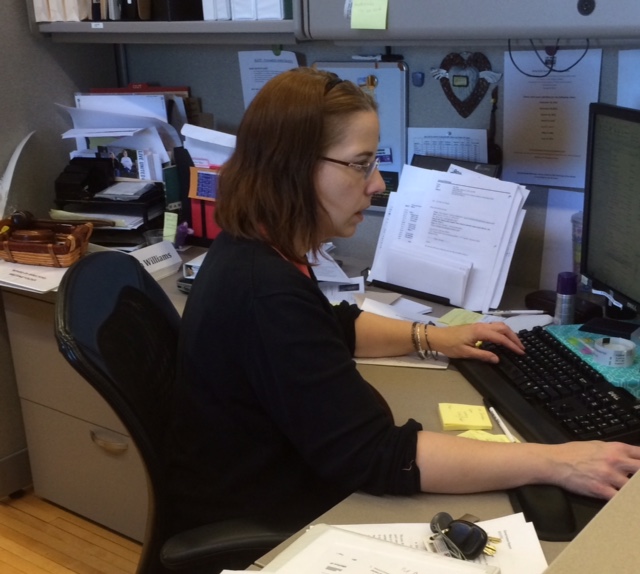

I’m an office administrator, executive office assistant.

This is a rude question in most circles but I’m a journalist. Can I ask a salary-ish that you make?

Right around $40,000

What percent of your household income has gone to medical expenses?

Depending on the month because we’re still you know with the debt, it’s you know 20-25 percent.

When you saw the ALICE report, what was your reaction?

I was actually shocked. It did not occur to me that there were that many community members, along with me, who were struggling. I guess you can see that, from the news every day, as you’re looking at foreclosures and you’re looking at people who are unemployed, and as you meet people on the street, there are people who are struggling. But I guess it did not occur to me how large the struggle was.

Had you considered yourself kind of a poor or low-income person before you saw the report?

You know, that’s a really good question. I considered myself struggling but I don’t think I would have categorized myself that way. You know, I just considered myself struggling and employed. It just felt like I hadn’t quite made it to the level that I hoped to yet.

$40,000 of salary does not sound on the surface like it’s a very low income.

No, it really doesn’t until you realize until part of that $40,000 is going to student loans. Part of that $40,000 is going to child support. Part of that $40,000 is going to car upkeep. Part of it is going to bills. I don’t have credit cards, I got rid of those a long time ago so I’m grateful for that but you know it’s the just the everyday stuff. Once you start dividing all of that stuff out, you know, it’s not really $40,000 any more.

What have you learned as part of being part of this ALICE awareness-raising campaign, and what have you learned about the situation across the state?

I’ve learned that it’s really important to recognize that this is a very vital part of our community. We are the people who are working at the front desks and the counters and the cutting people’s hair. I’m a part of a very large percentage of the population who gives back to the community.

So if we’re off balance, that center part of the community population has no way of giving back and yet we are still part of this population. They give to nonprofits. They recognize the importance because they feel that pull every day.

What would solve the ALICE problem.?

I think an awareness. I think community action. Really providing the services that help families to stabilize. If you’ve ever gone looking for rental housing, it’s great when you can find a house that’s affordable, $500, $600 a month.

And then you pay utilities on top of that, but what you don’t realize is you’re renting those houses is, if they’re not well insulated, if the windows aren’t good, if you don’t have a good heating system, then that family who thinks that they’re getting a deal when the move in at $500 or $600 a month really isn’t getting a deal because they’re making up for that in terms of the heating bills.

And transportation availability: if you don’t have a car or if you’re a one-car family and you have kids, you’re having to navigate the systems of trying to get your kids, and if you’ve ever tried to carry your kids to the doctor on a bus, that’s rough stuff. If you’re having the full conversation and you’re talking about how to find safe housing, how to make the neighborhoods more safe, how to provide families financial counseling and financial support as they’re trying to figure out how to do the budget and navigate all of those things, having that service available and having those people available to help that family to see things in a different light, and perhaps see different services that are available to them, is really important.

Powered by The Detroit Journalism Cooperative with support from The James L. Knight Foundation, The Ford Foundation, and Renaissance Journalism’s Michigan Reporting Initiative.